Payroll process in general refers to the process of calculating and paying salary to employees and statutory dues to government.

Depending on the company policy, payroll cycle can be of Daily, Weekly, Monthly, etc. Monthly is the most commonly used cycle in India. On the completion of each cycle, salary is paid to employees.

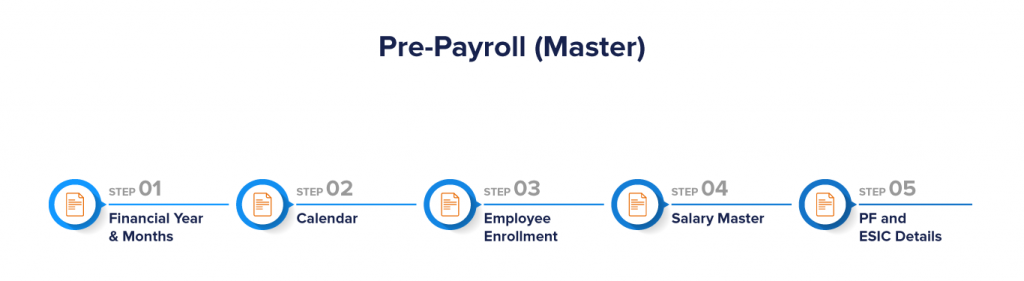

There are certain steps you need to follow to process salary correctly in factoHR. These steps can be categorized as pre-payroll process, payroll process and post-payroll process.

Pre-payroll process includes steps to prepare the system with necessary data inputs before salary can be processed.

1. Financial Year & Months

First step is to check availability of current financial year and month for which salary is to be processed. In Financial Year screen, check for the current year. If year is not created then add new year in the system and make it as default.

Check for monthly period in Months screen. If month is not available then create it from this screen.

– https://help.factohr.com/knowledgebase/financialyear/

– https://help.factohr.com/knowledgebase/months/

2. Calendar

Calendar will allow you to add National or Festival Holidays; week off’s and week-days as per your company’s policy. If there are multiple calendars for different regional branches then upload holidays for each calendar.

– https://help.factohr.com/knowledgebase/calendar/

3. Employee Enrolment

New employees, joined in the payroll cycle, are to be created in the system along with their Bank Account and PAN / AADHAR number details. This can be done in bulk import or one by one using Employee Enrolment screen.

– https://help.factohr.com/knowledgebase/employeemaster/

4. Salary Master

Salary data is to be updated in the system for all the new joinees and for any salary revision for existing employees.

From Salary Master screen you can add / edit salary details of employees with revision dates. Thus multiple salary revisions of employees with its effective date can be maintained.

WEF (with effective date) for every salary revision record must be there (For new & Existing) records to maintain past history of CTC and for any due payment/Arrears of previous months.

While processing payroll, system takes data from Salary Master and prorate the same based on attendance of the employee to calculate payable salary for the month.

– https://help.factohr.com/knowledgebase/salarymaster/

5. PF and ESIC

Once employee is created, we need to update statutory information related to PF, ESIC, EPS and NPS. The information include eligibility status, relevant statutory PF/ESIC/EPS numbers, date of membership etc.By default all employees are eligible for PF and ESIC unless specified here.

We are maintaining The PRAN NO field In case of Employee’s NPS deduction.

This information will be used for statutory calculation and in statutory reports like ECR/ESIC upload file and NPS contribution files.

– https://help.factohr.com/knowledgebase/pfdetails/

Once above steps are Verified proceed towards Pre-Payroll Process Monthly input part.

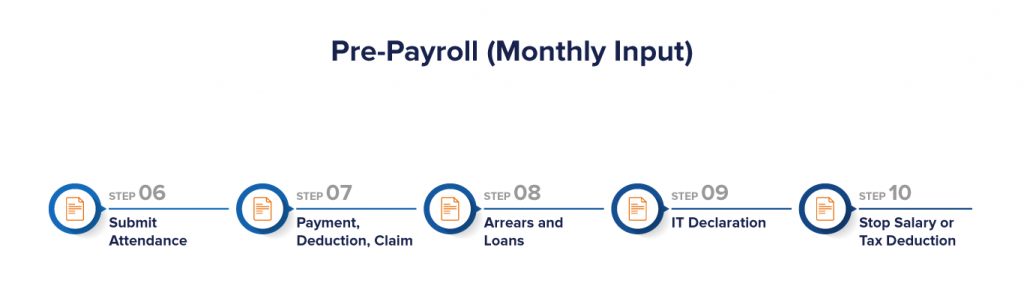

6. Submit Attendance

Once all the Attendance Regularization and Leave applications of employees are approved by respective managers or by HR Admin, system is ready to generate final attendance summary. This attendance summary is generated from Submit Attendance screen. It prepares data like number of Full days, Half days, Week-offs, Leaves, Holidays, Late and Early count, LOP etcetera for the selected attendance period. Once saved, this is used for salary calculation on prorate based .

– https://help.factohr.com/knowledgebase/submitattendance/

7. Payment / Deduction / Claim Screen

If you want to pay or deduct any amount under any component which is either not auto calculated by the system or you want to change system calculated value then the required amount is to be entered in this screen against specific components.

factoHR allows you to enter amount against all the components of Regular Earning, Variable Earning, Arrears, Reimbursement etc. To pay with monthly salary, please select “Salary” under Payment Process and required month in Month drop down.

In Payment/deduction/claim screen, 3 types of payment (Salary /Reimbursement /Off-cycle) can be provided.

8. Arrears & Loans

ARREARS Screen

Along with Salary if arrears is to be paid then it is generated from this screen. The arrears can be related to back dated Increment, previous months’ Attendance correction or Overtime. To pay with monthly salary, please select “Salary” under Payment Process and mention required date in To be paid in Payroll control.

Through ‘Arrears calculation’ screen of factoHR we can run system calculated arrears payment of Attendance Arrears , Salary arrears , late LOP arrears of past months with current month salary.

LOAN Application Screen

For regular recovery of Principal and Interest for the loans taken by employees, entry is to be made in the Loan Application screen.

– This screen is used by HR/Admin with necessary details of Loans like. Loan type, Interest type, Sanctioned loan amount, Loan date , Deduction start from (most important field).

– factoHR will continue the loan recovery (principle & interest) from employee’s salary till the full amount recovery of sanctioned amount is done.

9. IT Declaration

Investment Declarations helps employees to reduce their taxable income, so that they can maximise the take home pay

In IT Declaration screen, employee can declare all the investments which they want to make during the financial year under different exemption sections. As per the default configuration of factoHR tool, Till January payroll factoHR will consider all exemption based on provided declaration by employees for tax calculation Whereas at the end of Financial year or from February payroll, factoHR will consider only proof amount entered by HR/Admin (for actual taxable income /tax liability ) after checking of provided/uploaded proofs by employees.

Employees can update/upload their proofs of Investment scan copy in IT declaration screen of factoHR tool (through ESS access by every end user) and is checked by admin user and final proof amount is considered for exemption and income tax calculation.

10. Stop Payment and Stop Tax Deduction

Due to any reason if you want to stop Salary Process or Salary Payment for any employee, it can be easily configured in factoHR.

1.Stop Salary Process will not calculate salary of the mentioned employee for the mentioned period 2.Stop Salary Payment will calculate salary but exclude the mentioned(specified) employee from the Bank transfer files.

Similarly, if you want to stop Tax Deduction for any employee for specified period then input can be given to factor through ‘Stop tax’ screen with FROM & TO date.

After completing Pre-Payroll process move towards Payroll process.

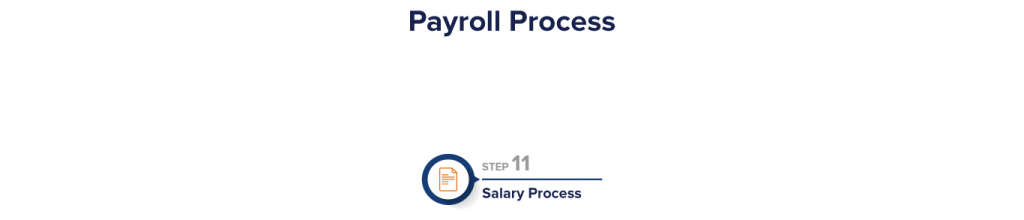

11. Salary Process

Once all the data is entered in the system as required by Pre-payroll activities, system is ready for salary calculation for the concerned period.

Based on the selected period, Salary process will read data from Employee Master, Attendance, Leave, Salary Master, Investment Declaration etcetera and calculate payable salary for the period. It calculates Gross, Deduction, Net and Provision components.

– https://help.factohr.com/knowledgebase/salaryprocess/

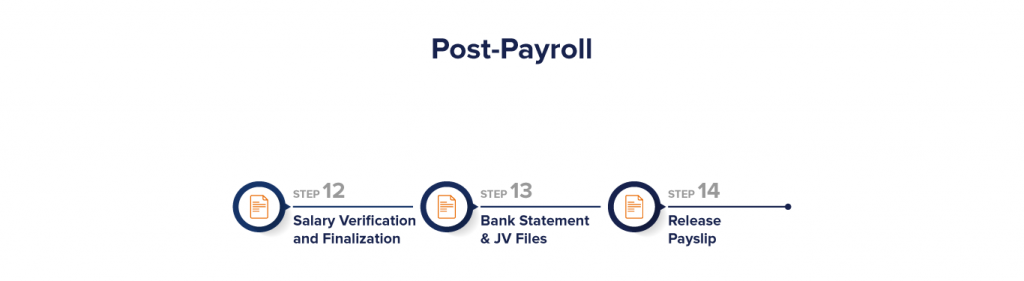

In Post Payroll process you can verify salary and release payslips.

12. Salary Verification and Finalization

Once salary processing is done, output of the system is verified against various inputs, checklist and reconciliation with previous months.

System provides you various reports to execute such checks and balances like Salary Register, Consolidated Register, IT Statement, Payslip, Reconciliation reports etcetera.

If salary is found in line with the expectation, it is marked as Finalized from the Salary Process screen.

13. Bank Statement & JV Files

Once Salary is finalized for a particular period, system allows you to generate Bank files and JV files for further payment to employees and input to account department.

14. Release report to Employees in ESS

Once Salary is processed then Finalized it from Salary Process screen. It will enable Payslip in ESS and Mobile App Login

Please refer to below video for better understanding:

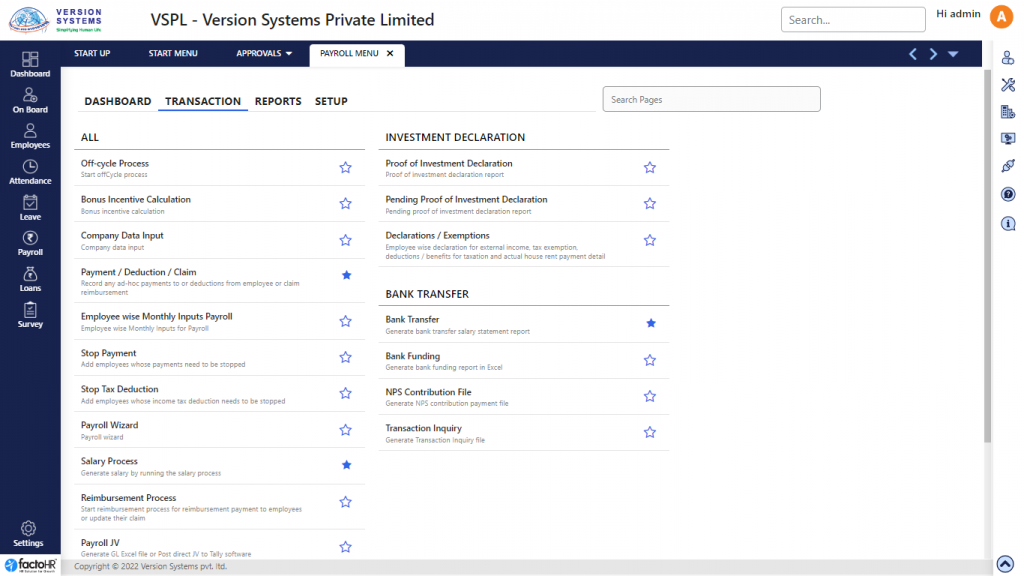

Here is the route to access the payroll module -> Home Page > Payroll Menu ( Click ) > All.

- Over there you will find 3 tabs like Transaction, Reports & Setup.

- Transaction :- You will fine Screens like Off-cycle process, Payment/Deduction/Claim, Salary Process, Leave Encasement, Bank Transfer etc.

- Reports :- There will be options to generate reports & slips like Salary Slip, Off-Cycle Slip, Reimbursement Slip, Salary Register, Off-Cycle Register, Consolidated Register, I.Tax Statement etc.

- Setup : – Accessible screens like Payslip General, Calendar, Financial Year, Payroll Group, Payroll Period etc.

Previous Step:- Apply Leave Next Step:- Financial Year